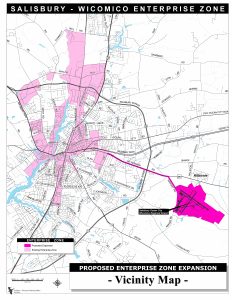

Eligible Area

Salisbury Wicomico Enterprise Zone Eligible Area

Or you can email [email protected] to see if your business is eligible.

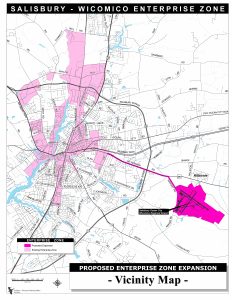

Eligible Area

Salisbury Wicomico Enterprise Zone Eligible Area

Or you can email [email protected] to see if your business is eligible.

Salisbury Wicomico Enterprise Zone – Printable Application

Enterprise Zone Program Information And Qualification Application